An Ho-4 Insurance Policy Typically Covers Which of the Following

Flood damage is excluded under standard homeowners and renters insurance policies. An HO-4 is not technically a homeowners policy as renters dont own their homes which is why this policy type excludes coverage for the buildings structure.

What Does An Ho3 Insurance Policy Cover People S Trust Insurance

Vehicle or aircraft damage to your property 8.

/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

. Homeowners Renters. The renters landlord would need a separate landlord insurance policy to help protect the structure of the rental property. HO-1 coverage against perils is the most basic type of home insurance policy for use in the event of damage and also the most limited in terms of coverage.

Youll probably want to get something like an HO-4 - Contents Broad Form. A QuiCk summAry of CoverAGe under eACh type of poliCy A. The amount of coverage provided by Coverage B is an amount equal to 10 of Coverage A.

This coverage is not applicable on the HO-4 policy form. Renters HO-4 CondoCo-op HO-6 Modified Coverage HO-8. A standard renters insurance policy is also known as an HO-4.

The HO-2 Broad Form is a named peril policy which generally covers the following perils. All of the following are true of Coverage B Other Structures EXCEPT. The amount of your dwelling coverage typically 10 to 20 percent or for a specific period.

Fire and lightning 2. An HO-4 does not cover damage to the rental unit. Heres a handy guide to coverage by policy typeand whats not typically covered.

For example the following companies cover sudden and accidental discharge or overflow of water or steam but there is no coverage if there is. It is a named perils policy and the standard form for this policy covers the. Removal of property endangered by any.

This type of policy form helps protect a renters personal belongings against 16 perils says the III. Land where the other structures are located is not covered. Texas Type of Coverage Policy Form ISO Policy Form HO-A HO 1 Named perils for both building and contents.

4 Maryland Insurance Administration 800-492-6116 www insurance maryland gov TABLE OFCNASOIRCADLAULFCLWECN AIE ONTEBC A QUICK SUMMARY OF COVERAGE UNDER EACH TYPE OF POLICY A. This is a renters insurance policy that covers your personal belongings against all 16 perils. Removal of property endangered by any insured peril 3.

It must be added by endorsement to a homeowners policy. It only covers your personal items and not the building making sense since the landlord is responsible for insuring the dwelling. Fire and lightning 2.

Riot and civil commotion 7. The HO-2 Broad Form is a named-peril policy which generally covers the following perils. Renters insurance policies are.

What Does An Ho3 Insurance Policy Cover People S Trust Insurance

What Is An Ho 4 Insurance Policy Coverage Com

Ho4 Policy Definition Kin Insurance

What Isn T Covered By My Homeowners Insurance Usaa

/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Homeowners Insurance Guide A Beginner S Overview

What Does Homeowners Insurance Cover

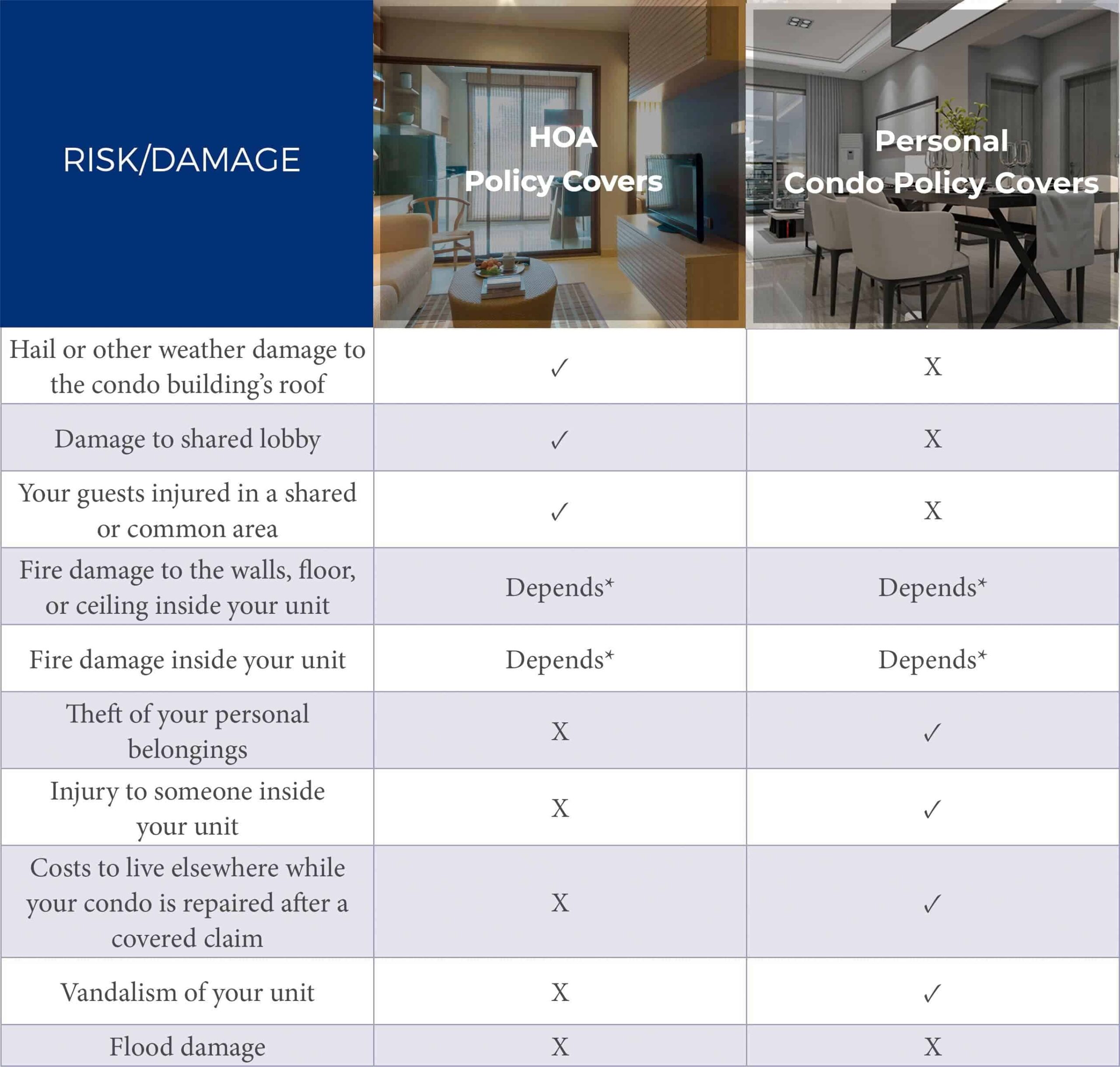

Texas Condo Insurance Get Protected

/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Homeowners Insurance Guide A Beginner S Overview

What Is The Difference Between Ho2 And Ho3 Homeowners Policies

8 Types Of Homeowners Insurance You Need To Know Hippo

Condo Vs Townhouse Policy Connect Condo Insurance

:max_bytes(150000):strip_icc()/modular-vs-manufactured-home-insurance-5074202_final-3c70b04af30a43c6ba0ba87089373bf7.png)

Modular Vs Manufactured Home Insurance

Understanding Your Homeowners Insurance Policies Liability Coverage

What Is An Ho 4 Insurance Policy Coverage Com

What Is The Difference Between Ho2 And Ho3 Homeowners Policies

What Is An Ho 5 Insurance Policy Coverage Com

Topic 9 Insurance Policy Provisions Bus 200 Introduction To Risk Management And Insurance Jin Park Ppt Download

Types Of Homeowners Insurance Insurance Com Homeowners Insurance Renters Insurance Homeowner

Comments

Post a Comment